Issuing a VAT invoice to your customers is a legal requirement if your business is VAT-registered, and you are supplying goods and/or services to another VAT-registered business. Certain exceptions to this requirement apply (for example, if the sale involves zero-rated or exempt goods). You must include various details on your VAT invoice to make sure it is legally compliant, which our VAT invoice template includes.

Issuing a VAT invoice to your customers is a legal requirement if your business is VAT-registered, and you are supplying goods and/or services to another VAT-registered business. Certain exceptions to this requirement apply (for example, if the sale involves zero-rated or exempt goods). You must include various details on your VAT invoice to make sure it is legally compliant, which our VAT invoice template includes.

You’re usually required to register for VAT with HMRC if your turnover for the previous 12 months is more than £85,000, or if you believe your annual turnover will move past £85,000 within the next 30 days. You can also voluntarily register.

This blog sets out when you need to register for VAT, when you need to send a VAT invoice, and what a self-billing arrangement is.

Contents

Registering for VAT

When to register

Generally, you must register with HMRC for VAT and charge it on your goods or services if:

- your VAT taxable turnover for the previous 12 months is more than £85,000; or

- you believe your annual VAT taxable turnover will exceed £85,000 within the next 30 days.

You might also need to register in some other cases, depending on what type of goods or services you sell and where you sell them. If you are in doubt about whether you need to register for VAT, you should speak to your accountant.

Even if your annual turnover does not meet the threshold, you can choose to voluntarily register for VAT (unless all the goods and/or services you sell are exempt). See our Q&A on VAT registration for guidance on why you might do this.

How to register

In most cases, you can register online with HMRC to pay VAT. You’ll need to provide certain information, such as your business activity, turnover and bank details.

Once you have registered you will receive a VAT number, and you must then go on to charge VAT on the goods and services you sell.

Failure to register

If you should have registered and you fail to do so, you may have to pay penalties.

When is a VAT invoice a legal requirement?

When a VAT invoice is a legal requirement

If you sell goods and/or services to another business, and you’re both registered for VAT, it is a legal requirement to send them a VAT invoice.

Usually, VAT invoices must be issued within 30 days of the date you supplied the goods or services, or if you were paid in advance, the date on which you were paid. You can send the VAT invoice in electronic form, as long as the customer accepts electronic invoicing. You must keep copies of all the VAT invoices you issue, and all the VAT invoices you receive.

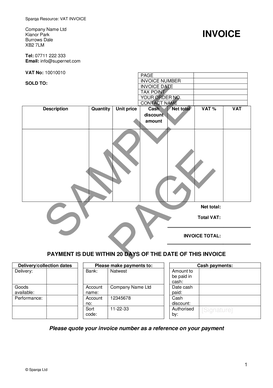

For information on what needs to be included in a full VAT invoice, see [this blog]. You can find a VAT invoice template at VAT invoice.

Note that if you are a retailer, you only have to provide a VAT invoice for UK sales if your customer requests one. If the sale is for goods or services costing £250 (including VAT) or less, you can provide a short-form VAT invoice (see VAT invoice – retail customers purchases of £250 or less).

When a VAT invoice is not a legal requirement

Only VAT registered businesses can send VAT invoices, so if your business is not registered for VAT you will not need to send VAT invoices. Even if you are VAT registered, you will not need to send a VAT invoice if:

- the sale only involves goods or services sold within the UK that are zero-rated or are exempt from VAT;

- the goods or services are a gift;

- you sell goods under a second-hand margin scheme (speak to your accountant for further guidance on these types of schemes); or

- you have agreed with the customer that they will write up their own VAT invoice. This is known as a ‘self-billing arrangement’. See further guidance below.

Self-billing arrangements

A VAT self-billing arrangement with your supplier is where you create VAT invoices for the goods or services they supply to you, and forward them a copy (usually along with the payment). These arrangements are most common when you work out the price for goods or services after you receive them.

If you want a self-billing arrangement, you must have a signed agreement in place with your supplier. These agreements usually last for 12 months and should be reviewed and renewed as required. Make sure you keep a copy of any self-billing agreement that you sign. The government has produced a self-billing agreement template that complies with the relevant law to assist you.

If you do not have a valid self-billing agreement, any invoices you produce for your supplier will not be valid and you will not be able to reclaim the VAT you have paid under them. Speak to your accountant for further guidance on self-billing arrangements.

The content in this article is up to date at the date of publishing. The information provided is intended only for information purposes, and is not for the purpose of providing legal advice. Sparqa Legal’s Terms of Use apply.

Marion joined Sparqa Legal as a Senior Legal Editor in 2018. She previously worked as a corporate/commercial lawyer for five years at one of New Zealand’s leading law firms, Kensington Swan (now Dentons Kensington Swan), and as an in-house legal consultant for a UK tech company. Marion regularly writes for Sparqa’s blog, contributing across its commercial, IP and health and safety law content.