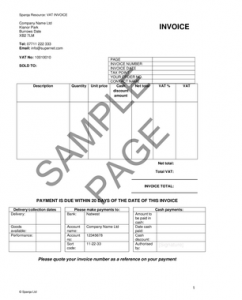

Use our legally compliant VAT invoice template or non-VAT invoice template to send to your customers, ensuring you cover all the necessary information required in an invoice template UK. You will usually need a VAT invoice template if your business is registered for VAT, unless certain exceptions apply.

Use our legally compliant VAT invoice template or non-VAT invoice template to send to your customers, ensuring you cover all the necessary information required in an invoice template UK. You will usually need a VAT invoice template if your business is registered for VAT, unless certain exceptions apply.

This guide explains what an invoice is and how to create your own customised template invoices, when to use a VAT or non-VAT invoice and what information to include, and what a self-billing arrangement is. By using the correct invoice templates, you’ll make sure you and your customers have the right information for your records, help protect your professional reputation, and avoid falling foul of the law.

Contents

Invoice template UK

What is an invoice?

An invoice (also called a bill) is a document that you give to a customer requiring payment for goods and/or services that you have supplied. An invoice is not the same as a receipt, which is provided to a customer as proof of payment. There are certain legal requirements for what an invoice template UK must include. Providing clear invoices is an important step to minimise the risk of late payments or disputes. Make sure you state the payment due date clearly on your invoices, include the correct bank account number, and advise any relevant credit period.

How do I create a UK invoice template?

- Select the appropriate UK invoice template from our site (VAT invoice template, non-VAT invoice template or VAT invoice for retail sales of less than £250 (including VAT)). If you aren’t sure which invoice to use, you can find guidance below to help you decide;

- Fill in the questionnaire to customise the template for your company;

- Download and save your invoice template;

- Fill in your customer’s contact details, invoice date, invoice number and other details;

- Print it onto your company’s letterhead;

- Send it to your customer!

To customise your invoice template correctly, you’ll need to provide the following information:

- Your company name and VAT number;

- Your contact email address, telephone number and address;

- The number of days within which payment is due; and

- The bank details to which payment should be made.

VAT invoice template

When do I need to send my customer a VAT invoice?

If you sell goods and/or services to another business, and both of you are registered for VAT, you will generally need to send them a VAT invoice. For more information on registering for VAT, see When to register for VAT.

Usually, VAT invoices must be issued within 30 days of the date you supplied the goods or services, or, if you were paid in advance, the date on which you were paid for supplying the goods or services. You can send the VAT invoice in electronic form, as long as the customer accepts electronic invoicing. You must keep copies of all the VAT invoices you issue, and all the VAT invoices you receive.

You can find a legally compliant VAT invoice template, which includes all the information you need, at VAT invoice. This template is customisable to your business needs.

There are specific rules for retailers (ie businesses that sell directly to the public) regarding VAT invoices on UK sales. If you are a retailer, you only have to provide a VAT invoice if your customer requests one. If the sale is for goods or services costing £250 (including VAT) or less, you need only provide a short-form VAT invoice. You can find a template at VAT invoice – retail customers purchases of £250 or less.

When should I send my customer a non-VAT invoice?

Only VAT registered businesses can send VAT invoices, so if your business is not registered for VAT you will not need to send VAT invoices and can send a non-VAT invoice instead.

Even if you are VAT registered, you will not need to send a VAT invoice if:

- the sale only involves goods or services sold within the UK that are zero-rated or are exempt from VAT;

- the goods or services are a gift;

- you sell goods under a second-hand margin scheme; or

- you have agreed with the customer that they will write up their own VAT invoice. These are known as a ‘self-billing agreement’ and ‘self-billed invoice’ respectively (see below).

Invoice requirements UK

What are the requirements for a VAT invoice template?

The invoice requirements for a UK VAT invoice depend on who it is for and what accounting scheme you are using. If you are not sure what VAT accounting scheme you are using, ask your accountant for advice.

Full VAT invoice

To create your own VAT invoice with all the legally required information included, you can use our VAT invoice template.

Your VAT invoice template UK will usually need to include the following information:

- a unique invoice number that follows on from the last invoice you sent (sequential numbering);

- your business name, address and VAT registration number;

- the date of the invoice;

- the name and address of the customer you are invoicing;

- a clear description of the goods or services provided, including quantity of goods or extent of the services;

- when the goods were sent, collected or made available or the services were performed;

- the rate of any cash discount;

- the applicable rate(s) of VAT. If some of the goods or services are exempt from VAT or zero-rated, it should be made clear that no VAT is being charged here;

- the total amount excluding VAT;

- the total amount of VAT (this must be expressed in sterling); and

- the total price payable including VAT.

Note that if you are paid by a customer in cash, if asked, you must endorse the customer’s copy of the invoice with the amount paid and the date of payment.

Retail customers making purchases of £250 (including VAT) or less

To create your own invoice containing all the legally required information, you can use our VAT invoice – retail customers purchases of £250 or less template.

You only need to include the following information on invoices for this type of transaction:

- your business name, address and VAT registration number;

- a clear description of the goods or services provided (the invoice should not contain any reference to any goods or service exempt from VAT);

- when the goods were sent, collected, or made available or the services were performed;

- the applicable rate(s) of VAT;

- if more than one rate of VAT is applicable, the total amount payable including VAT for each rate; and

- the total price including VAT.

There are currently different rules governing VAT invoices for trade to member states of the EU, for some suppliers of services or goods that are subject to a warehousing or fiscal warehousing regime, and for VAT margin schemes. If you require guidance on these rules, you can access a specialist lawyer in a few simple steps using our Ask a Lawyer service.

What are the requirements for a non-VAT invoice template?

Non-VAT invoices should contain enough information to secure payment from the customer and act as a record of the transaction. The following items are non-VAT invoice requirements in the UK:

- a title indicating that it is an invoice (rather than eg a receipt);

- if your business is a registered company, the full registered name, number and office;

- your contact details;

- the customer’s name and address;

- the date of the invoice;

- a unique identifying number (so that this invoice is not confused for another one);

- a detailed breakdown of what you are charging for and when it was supplied (more detail makes it easier to tell what the customer has been billed for when you or they look back at the invoice);

- the price of each item in the breakdown;

- the total price; and

- the date for payment together with any details about acceptable methods of payment.

Create your own invoice using our Non-VAT invoice template, which contains all the legally required information and is customisable to your business needs.

VAT self-billing arrangements

How do I enter into a self-billing arrangement with my supplier?

You may wish to enter into a VAT self-billing arrangement with your supplier, whereby you create VAT invoices for the goods or services they supply to you and forward a copy, usually with the payment. These arrangements are most common when you work out the price for the goods or services you purchase after receiving them.

If you want a self-billing arrangement, you must have a signed agreement in place with your supplier. These agreements usually last for 12 months and should be reviewed and renewed as required, although you can agree to a longer period. You can use the government’s self-billing agreement template to assist. You must keep a copy of any self-billing agreement that you sign.

If you do not have a valid self-billing agreement, any invoices you produce for your supplier will not be valid VAT invoices and you will not be able to reclaim the VAT you have paid under them.

Submitting VAT returns

When do I need to submit VAT returns and how?

If you are required to register for VAT you will need to submit VAT returns, showing how much VAT you owe to HMRC, every three months.

When you register online, you create a VAT online account which you will need in order to submit your VAT returns.

Your accountant can help you to submit the correct VAT returns in the appropriate format.

The content in this article is up to date at the date of publishing. The information provided is intended only for information purposes, and is not for the purpose of providing legal advice. Sparqa Legal’s Terms of Use apply.

Marion joined Sparqa Legal as a Senior Legal Editor in 2018. She previously worked as a corporate/commercial lawyer for five years at one of New Zealand’s leading law firms, Kensington Swan (now Dentons Kensington Swan), and as an in-house legal consultant for a UK tech company. Marion regularly writes for Sparqa’s blog, contributing across its commercial, IP and health and safety law content.