When you’re deciding on your business’s staffing needs, it’s important to have a clear idea of what your business’s requirements are; for instance, what work will be involved in the role, what time commitment will be required from the staff member and how much can your business afford to pay them. It is also helpful to have an idea of the different types of staff available to you, and the different benefits and burdens involved in taking those staff on. To assist you, this guide provides an overview of the different factors to bear in mind when considering taking on fixed term or temporary employees, including when it might be appropriate to hire them and what rights they are entitled to under employment law. It also provides a template fixed term contract that can be customised to your new employees.

When you’re deciding on your business’s staffing needs, it’s important to have a clear idea of what your business’s requirements are; for instance, what work will be involved in the role, what time commitment will be required from the staff member and how much can your business afford to pay them. It is also helpful to have an idea of the different types of staff available to you, and the different benefits and burdens involved in taking those staff on. To assist you, this guide provides an overview of the different factors to bear in mind when considering taking on fixed term or temporary employees, including when it might be appropriate to hire them and what rights they are entitled to under employment law. It also provides a template fixed term contract that can be customised to your new employees.

Fixed term contracts

What is a fixed term contract?

A fixed term contract is used when you are hiring a member of staff on a fixed term or temporary basis. This means that the contract will come to an end on a certain date, or when a certain event happens (eg when a specific project is completed). This is in contrast to permanent contracts, where there is no end date specified. It might also be called a temporary employment contract.

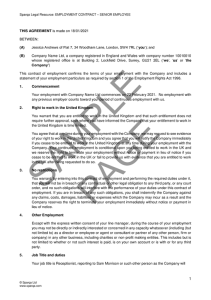

For template contracts you can use to hire a member of staff on a fixed term basis, see Employment Contract – Junior Employee and Employment Contract – Senior Employee.

Rights of fixed term employees

What rights do employees on fixed term contracts have?

Fixed term or temporary employees have all of the same rights as your permanent employees (eg to holiday and sick pay); see our Q&A on Employees for a full run through.

They also have some additional rights, designed to prevent them being disadvantaged by their temporary status. These are as follows:

- Except in very limited circumstances, you must give your temporary employee the same pay or benefits that full-time employees get, just pro-rated for how long they will be with you (see more below).

- Before your temporary employee’s contract ends, you must follow a fair process, including telling them about any vacancies in your business. See Ending contracts with fixed-term/temporary employees for more information.

- You must not select a temporary employee for redundancy just because they are a temporary employee unless you can objectively justify doing so. Note that the act of not renewing an employee’s temporary contract can amount to making them redundant and make you liable for a redundancy payment. See Ending contracts with fixed-term/temporary employees for further information.

- If you keep a temporary employee on for more than four years they will automatically become your permanent employee unless you have a real business reason for why they should remain as a temporary employee (eg if they are needed as temporary cover for various absent staff on an ongoing basis – most likely in a large workforce).

Can I pay my temporary employees less, or give them fewer benefits, than my permanent employees?

No; except in very limited circumstances, you must give your temporary employee the same pay or benefits that full-time employees get, just pro-rated for how long they will be with you. This means that you must not give them a less favourable contract simply because they are on a temporary contract, unless the overall package you are offering them is at least of the same value as what you are offering to full-time employees, otherwise you may face a claim for discrimination.

You can only give your temporary employees less favourable terms if you have a real business need to do so and you have balanced that need against the impact on the employee before deciding to treat them differently. In such a case, it is usually advisable to provide a payment to the affected employee to ensure your temporary employee’s overall package is of the same value as your comparable permanent employees. This will reduce the risk of them raising allegations that you have treated them unfairly and, if they were to bring a claim, will put you in a good position to defend it.

Example: Your temporary employee is on a four-month contract. A comparable permanent employee has a company car. The cost of providing this for four months is disproportionate. It is sensible to ensure their overall package is at least the same value by providing a financial payment or other benefit to reflect this difference.

Can I fire an employee more easily if they are on a temporary, rather than a permanent, contract?

No. Ending a temporary employee’s contract (without renewing it) will usually amount to a dismissal for the purposes of employment law, even if you are ending the contract simply because its fixed term has expired. This means that you could risk claims for unfair dismissal if you do not follow the correct process when ending the contract. You could also face claims for breach of contract if you fail to take into account any provisions set out in the contract (eg a requirement to give a certain amount of notice of termination).

See Process for dismissing an employee for more information.

Hiring fixed term employees

What do I need to know about hiring a fixed term or temporary employee?

If you are hiring an employee on a fixed term contract, key things to be aware of are:

1. Employment rights

An employee has the most legal rights and benefits of any type of staff. Hiring an employee on a fixed term or temporary contract does not reduce these rights (see above).

2. Employment contract

You must give your temporary employee a written statement of certain basic terms of employment before or on their first day of employment. The employment contract must, most importantly, say when it will end, whether this will be on a certain date or when a certain event happens, or does not happen (eg the completion of a specific project they were hired for, or the return to work of a permanent employee on maternity leave). For guidance about such contracts, see Employment contracts, and for templates you can use, see Employment Contract – Junior Employee and Employment Contract – Senior Employee.

3. National Insurance contributions and income tax

You are legally obliged to deduct your employee’s income tax at source and pay their income tax contribution through the Pay as You Earn (PAYE) system. You must also deduct National Insurance contributions from your employee’s pay using the PAYE system, as well as making your own contributions in relation to each employee. For guidance about how to set up a payroll system to deal with these issues, see Process for paying staff.

4. Pension contributions

You are very likely to have to enrol your temporary employees in a workplace pension scheme and to pay contributions (on top of their wages) towards that pension. Broadly, employees aged between 22 and state pension age, and earning more than £10,000 per year are eligible. See Choosing and setting up a staff pension scheme for full details.

5. Health and safety

You are responsible for taking care of your employees’ health and safety at work. Failure to comply with health and safety law can result in criminal liability for your company and any director, manager or officer responsible. You will typically need to have employers’ liability insurance with a minimum of £5 million cover. Guidance on how to comply with your health and safety obligations can be chiefly found in Health and safety policy, Health and safety training for staff and Health and safety risk assessments.

When is it appropriate for my business to hire a temporary employee?

You should consider hiring a temporary employee if you want the security and high level of control you get over an employee, but you only need someone to work for a limited period of time. This could be, for example, if you need cover for an employee who will be absent for a period of time (eg due to maternity leave) or if the work is seasonal in nature.

You should consider hiring a staff member as a temporary employee when all or any of the following apply:

- You want to be able to control when, where and how that staff member must carry out their work and to be able to set the hours they must work;

- You need that specific staff member and them alone to do the work that your business requires and they will not have the right in their contract to provide a substitute to do the job if they are unavailable;

- The staff member will be fully integrated into your business (eg they will have their own email address, own desk and be able to use your disciplinary and grievance process);

- The staff member will not be entitled to refuse work from you;

- You anticipate having enough work to keep the staff member busy during their contracted hours, or you are prepared to pay the staff member a regular wage even if you have no work to give them; and/or

- You want to stop the staff member from taking on other work (you will not typically need or want to do this if they are part-time, as they may of course have another job).

For template contracts you can use to hire a temporary member of staff, see Employment Contract – Junior Employee and Employment Contract – Senior Employee.

You must be aware that whilst you will have much more control over employees than other types of staff, the other side of this is that employees have the most legal rights and benefits of all staff. It is typically time consuming and a bigger administrative burden to take on an employee than other types of temporary staff, such as freelancers; for example, you will need to set up a payroll system to deduct your employee’s income tax at source and make National Insurance contributions.

Using temporary employees to provide cover for absent staff

If you need to cover a prolonged period of absence (eg an employee’s maternity leave), you could consider hiring a temporary employee. In doing so, bear in mind that while you will have more control over employees than other types of staff (eg zero hours or agency staff), temporary employees have the same rights as permanent employees (eg holiday and sick pay), together with some additional protections designed to prevent them being disadvantaged by their temporary status (eg the right to be informed of available vacancies in your business). Temporary employees are less likely to be appropriate if you only need cover for very short periods of time as the administrative burden on your business is higher than, for example, if you were to hire agency or zero hours staff.

Using temporary staff to cover a short-term, specialist task

If you need a certain amount of control over how and when a specific task is done, you could consider hiring a temporary employee with a specialist skill set. This will not be appropriate, however, if you need to retain the specific skill set in-house once the project is complete, and in such cases it may be more appropriate for you to hire a permanent employee.

Hiring temporary staff if your business has fluctuating needs

If your business has seasonal or fixed-term work, it may be appropriate for you to hire a temporary employee for the period. For example, if you want the staff member to be fully integrated in your business (eg with their own email address and desk) and need them to be able to work for you as and when you need, with no right of refusal, it is likely to be more appropriate for you to take on a fixed term employee than a self-employed contractor. This will only be appropriate, however, where you have enough work to keep the staff member busy during their contracted hours, or if you are prepared to pay them even when you have no work for them to do. Given the additional administrative burdens and costs associated with taking on employees, it is also only likely to be worthwhile for your business if you are sure you will be able to provide a certain amount of guaranteed work.

The content in this article is up to date at the date of publishing. The information provided is intended only for information purposes, and is not for the purpose of providing legal advice. Sparqa Legal’s Terms of Use apply.

Before joining Sparqa Legal as a Senior Legal Editor in 2017, Frankie spent five years training and practising as a corporate disputes and investigations lawyer at leading international law firm Hogan Lovells. As legal insights lead, Frankie regularly contributes to Sparqa Legal’s blog, writing content across employment law, data protection, disputes and more.