As discussed in our recent blogs, small claims are simple and relatively low-value legal claims brought in the County Court (less than £10,000 in value). The time limit for bringing a small claim is usually six years from the date your right to make a claim first started. For example, this can be six years from the date your supplier didn’t deliver goods you’d requested, or your customer didn’t pay an invoice when due.

As discussed in our recent blogs, small claims are simple and relatively low-value legal claims brought in the County Court (less than £10,000 in value). The time limit for bringing a small claim is usually six years from the date your right to make a claim first started. For example, this can be six years from the date your supplier didn’t deliver goods you’d requested, or your customer didn’t pay an invoice when due.

Find out below about the time limit for bringing small claims, how long it takes for small claims to be heard, how to write a letter before action, and what happens if the other side ignores your small claim. Our previous blogs discussed the basics of what a small claim is and how much it costs to bring a small claim.

Is there a time limit for bringing small claims?

Time limit for bringing most small claims

The time limit for bringing most small claims is within six years of the date of the breach that gave rise to the small claim (eg the due date of an unpaid invoice). However, it’s best to try to resolve matters as soon as possible. The longer you wait, the harder it can become to provide the relevant evidence and get paid. You also risk your debtor going out of business in the meantime.

When will a small claim be heard

The date your small claim is heard in court, and if it is heard at all, depends on whether or not your claim is defended. If the other side does not defend the small claim, it can be decided between six to eight weeks without the need for a hearing. However, if the defendant does dispute the claim and a hearing is required, it will take much longer as the court will have to give you a trial date. In this case, your claim should usually be heard within twelve months.

What do I need to do before starting a small claim?

There are certain rules you need to follow before starting your small claim. It’s important to comply with these rules because the judge hearing your small claim will take this into account when deciding how much money to award you. You must:

- read the rules on preparation that apply to your case and do what they say:

- in all cases read the Practice Direction for Pre-Action Conduct; and

- depending on what your claim is about, you may also need to look at specific rules for your type of claim. See our Q&A for further guidance on these rules;

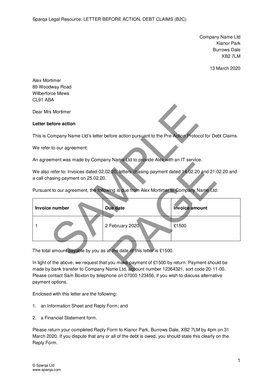

- write a formal letter to the other side, explaining what has happened, warning that you are going to sue them and saying what you want from them (known as a letter before action or a letter of claim). See Letter before action, debt claims (B2B), Letter before action, debt claims (B2C) and Letter before action, non-debt claims for templates you can use; and

- try to negotiate and settle the matter between you before starting a small claim. See below for guidance on how long to wait after sending your letter before action before proceeding with your small claim.

Many people bringing a small claim represent themselves instead of hiring a lawyer, but you are entitled to get legal advice and be represented at court by a lawyer if you wish. You can access a specialist lawyer in a few simple steps using our Ask a Lawyer service.

Use Small claims toolkit for a how-to guide and relevant template documents to assist you with a small claims process.

Waiting after a letter before action to proceed with a small claim

How long you have to wait after bringing the letter before action will depend on what type of claim it is specifically:

| Claim type

|

How long after your letter before you can sue

|

| Money owed by an individual or a sole trader

|

30 days from the date of your letter of claim

|

| Money owed by an individual or sole trader who is seeking debt advice

|

At least 30 days from the date you receive their reply form telling you they are getting debt advice, longer if they ask for it and it is reasonable

|

| Money owed by an individual or sole trader who has asked you to send them documents

|

30 days from the date you provide those documents, or (if later) 30 days from the date you receive their reply form if it says they wish to get debt advice

|

What happens after bringing the small claim

After you have started your small claim, the court will send a copy of it to the defendant. The defendant must respond within 14 days of receiving full details of your claim; the full details of your claim are known as the particulars of claim.

There are several ways the defendant can respond to your small claim:

- Paying you;

- Admitting (accepting as true) the claim but not paying you up front (they may agree to a payment plan);

- Filing a notice of admission;

- Admitting part of the claim and defending the other part of the claim;

- Defending the whole claim; or

- Filing an acknowledgement of service (this gives the defendant 14 more days to prepare their defence).

It is also possible (and common) for the defendant to ignore a small claim. This is when they give no response after 14 days of receiving the full details of your claim. In this case, you can apply for a default judgment. This is where the court gives judgment in your favour without a trial and without assessing the rights and wrongs of the case.

See our Q&A for further guidance on small claims hearings, including what to do if a small claim is brought against your business and how to prepare for a small claims hearing.

The content in this article is up to date at the date of publishing. The information provided is intended only for information purposes, and is not for the purpose of providing legal advice. Sparqa Legal’s Terms of Use apply.

Marion joined Sparqa Legal as a Senior Legal Editor in 2018. She previously worked as a corporate/commercial lawyer for five years at one of New Zealand’s leading law firms, Kensington Swan (now Dentons Kensington Swan), and as an in-house legal consultant for a UK tech company. Marion regularly writes for Sparqa’s blog, contributing across its commercial, IP and health and safety law content.