Earlier this month the Government announced tougher measures to tackle the problem of late payments to small-to-medium-sized businesses (SMEs), following on from its Prompt Payment and Cash Flow Review. Late payment of invoices is a key barrier to SME growth, resulting in staff spending excessive time chasing payments, as well as problems with cash flow.

Earlier this month the Government announced tougher measures to tackle the problem of late payments to small-to-medium-sized businesses (SMEs), following on from its Prompt Payment and Cash Flow Review. Late payment of invoices is a key barrier to SME growth, resulting in staff spending excessive time chasing payments, as well as problems with cash flow.

New measures to be announced in the Prompt Payment and Cash Flow Review include:

- extending payment performance reporting obligations through legislation, including new ways of reporting payment performance and reporting on retention payments for businesses in the construction sector;

- providing more advice to businesses on negotiating payment terms to suit them, and how to go digital to better manage their invoices and cash flows;

- increasing the powers of the Small Business Commissioner, so that they can undertake investigations and publish reports on the basis of anonymous intelligence, where necessary; and

- strengthening the Prompt Payment Code so that business signatories must confirm their commitment to it every two years.

Our blog explains the steps you can take to recover late payments without going to court and directs you to the documents and toolkits you need to make sure your business recovers payments quickly, thus allowing you to focus on your business growth and customers.

What steps can I take to recover a late payment without going to court?

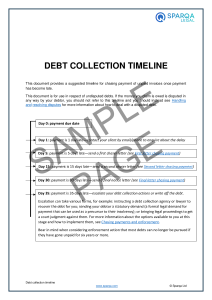

Once a payment becomes late, you should immediately take steps to chase your debtor. You can use our suggested timeline for chasing payment of unpaid invoices: Debt collection timeline. You can also find this timeline, along with a how-to guide and all the documents you need, in our Debt collection toolkit.

The steps you take to chase payment of an invoice are ultimately a commercial decision for your business, but below is a suggested cost-effective course of action to follow before you take your debtor to court.

- Make immediate contact

Find out why there has been a delay. Be polite and professional but make it clear that you expect payment within a certain time frame. Follow up with a further phone call or email if a specific time frame is agreed and payment is still not received. Confirm any phone calls with an email or letter recording in writing what was said. It’s important to have a written record of your correspondence where possible. - Send chasing letters

The below is a suggested timeline for escalation:- if your invoice remains unpaid five days after it has become late, send First letter chasing payment;

- if your invoice remains unpaid 15 days after it has become late, send Second letter chasing payment, explaining that if payment is not received promptly, you may charge interest on the debt and/or apply a late payment charge; and

- if your invoice remains unpaid 30 days after it has become late, send Final letter chasing payment, explaining that if payment is not received, you will apply interest and other debt recovery charges (if appropriate) and will take further debt recovery action.

- Formally escalate your debt recovery actions

Consider the impact of taking formal action against a customer on your ongoing business relationship with them, and any cost implications. Weigh up whether the costs and time involved in escalating your debt recovery actions are worth your while or whether you would be better placed to simply write off the debt. You can find a how-to guide and all the documents you need in Debt collection toolkit.

I have chased and no payment has been made. What can I do next?

If you have chased money owed to you and no payment has been forthcoming, there are various options available to you. Consider whether any of the following are suitable:

- Using a debt collection agency or lawyer

This can be a cost-effective method of getting your money back if your relationship with your client has already broken down. See our Q&A for more guidance on using a debt collection agency. - Alternative dispute resolution (ADR)

You can use any alternative dispute resolution scheme that you are part of, for example if you are a member of a trade association which runs its own scheme. If the money is owed to you by a larger business, you might be able to complain to the Small Business Commissioner about them. The Government is increasingly encouraging businesses to use ADR, which can often provide a quicker solution, and may preserve existing business relationships and supply chains. - Statutory demand

Consider sending your debtor a type of formal demand for payment, called a statutory demand. You can find more guidance on statutory demands in our Q&A. - Selling the debt

You could sell the debt to someone else if you have immediate cash flow concerns and do not want to pursue the debt yourself, for example if you do not have the time or resources to do so – see our Q&A for more information. Such sales are usually at a substantial discount.

For more guidance, including how to ensure prompt payment in the first place, see our detailed Q&A.

The content in this article is up to date at the date of publishing. The information provided is intended only for information purposes, and is not for the purpose of providing legal advice. Sparqa Legal’s Terms of Use apply.

Marion joined Sparqa Legal as a Senior Legal Editor in 2018. She previously worked as a corporate/commercial lawyer for five years at one of New Zealand’s leading law firms, Kensington Swan (now Dentons Kensington Swan), and as an in-house legal consultant for a UK tech company. Marion regularly writes for Sparqa’s blog, contributing across its commercial, IP and health and safety law content.