A share transfer form, also called a stock transfer form, is a legal form used to transfer shares in a company from an existing shareholder to a new person or company. Even if a share purchase agreement or sale agreement is used to set out the terms of the share transfer, you will always need a separate share transfer form to legally transfer the shares.

A share transfer form, also called a stock transfer form, is a legal form used to transfer shares in a company from an existing shareholder to a new person or company. Even if a share purchase agreement or sale agreement is used to set out the terms of the share transfer, you will always need a separate share transfer form to legally transfer the shares.

This guide sets out what a share transfer form (or stock transfer form) is, how to use it, and the process of transferring shares. It also covers what a share purchase agreement is and what terms are usually included in a share purchase agreement.

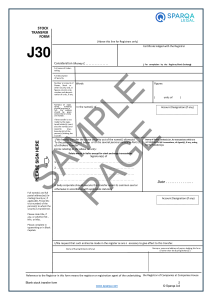

A share transfer form, also called a stock transfer form or a J30 form, is a short legal document used to transfer shares. The transferring shareholder fills the form in to complete a share transfer. There is no universal template for a stock transfer form, and the format can vary slightly depending on the template used. It should always include: details of the buyer and seller of shares; the number and type of shares being transferred; the agreed price for the shares; and the date of the transfer.

For a template of a commonly used style, see our Blank stock transfer form. Once completed, a stock transfer form needs to be signed by the seller of the shares to give legal effect to a transfer.

For an example of a commonly used style, you can click the button above or follow this link to download a blank stock transfer form. The person transferring the shares should complete the form. For a step-by-step guide to filling in the stock transfer form, including what details to insert, see this Step-by-step guide to completing a stock transfer form.

Once the stock transfer form is completed, it must be sent by the transferee either to HMRC for payment of stamp duty, or to your company if stamp duty is not payable. See our Q&A for further guidance.

Note that the content here is only relevant if the shares are fully paid up at the time of transfer (ie the shareholder has paid your company the full nominal value of the shares).

There is a set transfer procedure to follow when a shareholder sells their shares, whether voluntarily (eg if exiting the company or restructuring) or involuntarily (eg if the shareholder is a director and their contract says they must sell their shares if they are removed from office). See below for further guidance.

In a few exceptional cases it is possible for shares to change hands without a sale taking place, in which case the set transfer procedure is not followed. For example, an individual shareholder’s shares transfer automatically to their personal representatives when they die, or to their trustee in bankruptcy if they become bankrupt. This is known as transmission of shares.

In order to transfer shares, you should:

1. Check your company’s articles of association and any shareholders’ agreement

The freedom of your company’s shareholders to transfer their shares might be limited by your articles or by agreement. You can find further guidance in our Q&A.

2. If desired, negotiate and agree the terms of a share purchase agreement

A share purchase agreement is entirely optional. It will only be relevant if there are specific legal terms that you want to attach to the transfer of shares. See below for further guidance on what a share purchase agreement is. If you want one, you will need the help of a lawyer to negotiate and agree the terms of a share purchase agreement. For access to a specialist lawyer in a few simple steps, you can use our Ask a Lawyer service.

3. Fill in a stock transfer form

For it to have legal effect, the parties need to properly document the share transfer. A stock transfer form completed by the transferor is the best way to do this. Note, even if you are entering into a separate share purchase agreement, you still need to fill in and sign a stock transfer form.

4. The transferee pays the purchase price (if any) to the shareholder

In exchange for any agreed payment, the transferring shareholder gives the person to whom the shares are being transferred the completed stock transfer form and the existing share certificate(s).

5. Pay any stamp duty within 30 days of the stock transfer form being signed and dated

Stamp duty is payable if the price for the share transfer is more than £1,000, unless certain exemptions apply. You can find more guidance here. If you are unsure about whether stamp duty is payable, you should seek separate tax advice or contact HMRC.

6. Approval (or refusal) of the share transfer by your company’s board of directors

After HMRC have confirmed payment of stamp duty (or the certificate is completed to confirm no stamp duty is payable), the stock transfer form should be sent to your company along with the HMRC confirmation and any other relevant documentation such as the transferring shareholder’s original share certificate. Your board must review the documentation to check all is in order and decide whether to approve or refuse the transfer. In most cases, this is a formality.

See our Q&A on Directors’ approval of a share transfer for further guidance on refusing or approving a share transfer.

7. Update your company’s register of members

Once your board of directors has reviewed and approved a share transfer, your company needs to give legal effect to it by updating its register of members, cancelling the transferring shareholder’s old certificate and issuing a new certificate to the transferee.

The register of members must be updated as soon as reasonably practicable after the transfer is approved. It is a criminal offence committed by your company and any officer at fault to fail to keep your register of members up to date, punishable by a fine. For guidance on how to update your register of members, see our Q&A on keeping a register of members.

8. Check whether the transfer changes the persons with significant control of your company (PSCs)

After any transfer of shares, you must check whether the transfer affects who has significant control of your company – for example, if the transfer increases an individual’s total shareholding to over 25% (or indeed reduces it to below 25%).

See our Q&A on how to identify and notify people with significant control of a company (PSCs) for guidance on how to identify the people with significant control (PSCs) in respect of your company, and the steps you need to take.

If a share transfer does not affect who has significant control of your company, there are no additional steps to take here.

Our Share Transfer Toolkit sets out the process to follow in order to transfer shares and contains all the documents a company will need to properly approve and register a share transfer.

A share purchase agreement is a contract between a buyer and seller setting out the agreed legal terms for a transfer of shares. Unlike a stock transfer form (also called a share transfer form), which is only two pages long, a share purchase agreement is a longer and more complex legal agreement.

No. There is no requirement for the seller and buyer of shares to use a share purchase agreement in order to transfer shares. All that is required to transfer shares is a stock transfer form (also called a share transfer form) signed by the seller. Nevertheless, in some cases a buyer and seller may want additional legal terms to apply to the transfer of shares. This is particularly true where a large stake, or entire ownership, of a company is being transferred.

In such cases, as the buyer is acquiring a majority stake or full ownership of a company, they may want additional comfort from a seller regarding the state of the business that they are buying. In return, a seller may want some protection and limits on their potential liability to the buyer following completion of the transfer. Entering into a share purchase agreement can help the parties to achieve these aims.

The terms of a share purchase agreement will typically include some or all of the following:

- legal steps and obligations that the seller and buyer must perform on completion of the sale;

- restrictions on a seller from competing with the company after completion of the sale, or from soliciting staff, customers or suppliers from the company;

- personal warranties from the seller to the buyer about the company and its business; and

- limits on the seller’s potential liability to the buyer after completion of the share transfer.

Ultimately, it is for the buyer and seller to decide whether a separate share purchase agreement is necessary or desirable in their circumstances. As the obligations in a share purchase agreement are personal to the parties, it is not advisable for a seller or buyer to enter into such an agreement without first obtaining expert legal advice. For access to a lawyer in a few simple steps, you can use our Ask a Lawyer service.

The content in this article is up to date at the date of publishing. The information provided is intended only for information purposes, and is not for the purpose of providing legal advice. Sparqa Legal’s Terms of Use apply.

Marion joined Sparqa Legal as a Senior Legal Editor in 2018. She previously worked as a corporate/commercial lawyer for five years at one of New Zealand’s leading law firms, Kensington Swan (now Dentons Kensington Swan), and as an in-house legal consultant for a UK tech company. Marion regularly writes for Sparqa’s blog, contributing across its commercial, IP and health and safety law content.